[ad_1]

Anna Webber/Getty Images Entertainment

Investment Thesis

Kohl’s (NYSE:KSS) has experienced a recent decline in its financials, and its execution of incorporating Sephora’s shop-in-shops into its stores can be seen as an aggressive effort to boost its growth and drive more recovery. However, not only the sales and topline but also its overall balance sheet needs a turnaround. The sales goal from Sephora that it set out to achieve by 2025 may not be sufficient, as other cuts in expenses and plans in debt reduction are also needed. After factoring in all the risks, we believe the stock has more room to decline.

Company Overview

Kohl’s, organized in 1988 and headquartered in Wisconsin, is a leading omnichannel retailer operating 1,170 stores and a website. It sells moderately-priced private and national brand apparel, footwear, accessories, beauty, and home products.

Strength

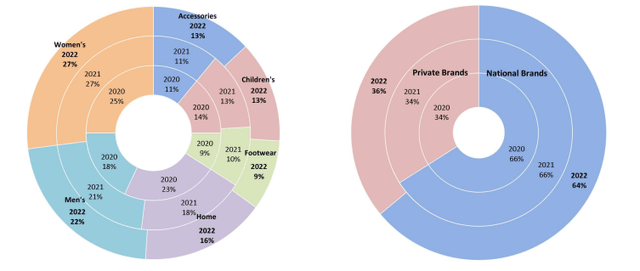

Kohl’s net sales penetration has steadily grown in the past three years. It has seen an expansion in Women’s and Men’s categories but less in Home and Footwear. The private brands that it carries also see modest 2% growth, with the national brand decreasing by 2% in 2022 compared to the previous year.

Kohl’s Sales Growth (Company 2022 10K)

In an effort to drive more sales in the Women’s category, Kohl’s has embarked on a very rapid expansion of Sephora stores, with over 600 stores opened since 2022, including 250 to open in 2023. The company’s expected payback for these stores is in a 3.5 years’ time frame. The company entered an arrangement with Sephora in 2020 to be the exclusive beauty offering through Sephora-branded retail shop-in-shops in about 1,100 Kohl’s stores and online. The arrangement is Kohl’s provides capital expenditure and inventory management while Sephora provides the products and merchandising based on their own network and marketing research.

Kohl’s Continued Growth through Sephora (Company Presentation)

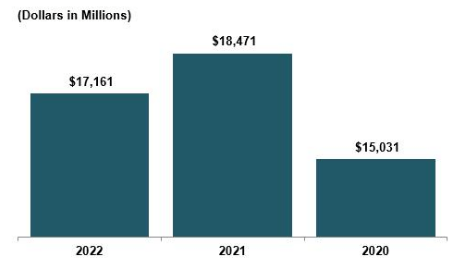

The comparable sales in the past three years are in the range of $15-18 billion. With opening a total of 650 new Sephora shops in ’22-’23, the company is hoping to reach $2 billion in sales provided by this project by 2025.

Kohl’s Net Sales (Company 2022 10K)

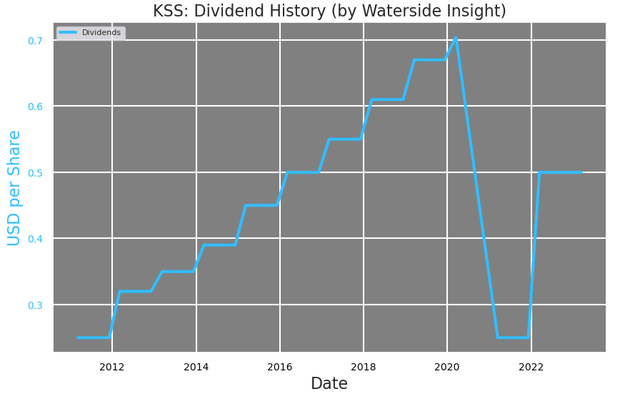

Kohl’s has always iterated its strong commitment to return to shareholders. It has been hiking dividends on a regular basis before the pandemic. After a drop, it resumed the hike in 2022. It currently provides a 6.18% dividend yield to common stockholders.

Kohl’s Dividend History (Calculated and Charted by Waterside Insight with data from company)

Weakness/Risks

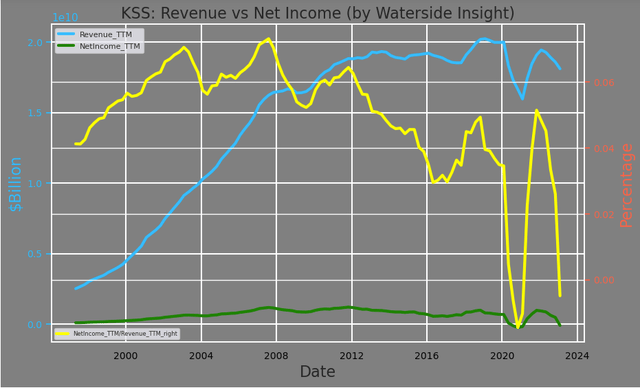

Kohl’s revenue dropped during the pandemic, with some recovery since 2021. But its net income in the latest quarter once again fell back down the previous lows on a TTM basis. It resulted in a large retreat of net income as a percentage of the revenue.

Kohl’s Revenue vs Net Income (Calculated and Charted by Waterside Insight with data from company)

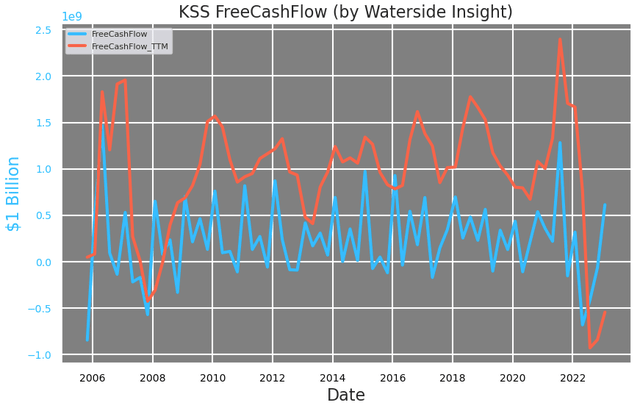

On the liquidity front, its free cash flow has fallen off a cliff on a TTM basis. Although the last quarterly data showed a climb back to the average, it needs to maintain this level to have a sustained recovery. With the company still expecting a slight decrease of -2% to -4% YoY in net sales in 2023, the TTM free cash flow could still stay below average for the next few quarters. If its cash flow cannot sufficiently be lifted in a few quarters, its dividend growth risks being stagnant or cut again.

Kohl’s Free Cash Flow (Calculated and Charted by Waterside Insight with data from company)

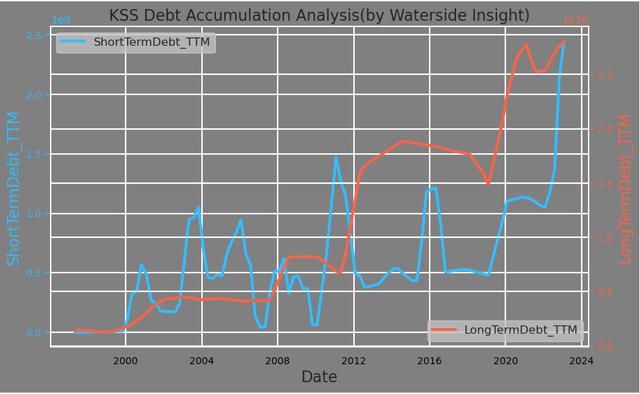

The latest development on its debt accumulation shows it has used more short-term debt than long-term debt to fund its development of the Sephora project. On a percentage basis compared with itself, the short-term debt had risen much faster than the long-term debt since 2020, when it signed into the agreement with Sephora. The company acknowledges its rising leverage and pledged no “anticipated borrowings” through the end of 2023. And it does not plan on doing any new share repurchases until the balance is strengthened. But it still needs to make substantial payments to lower the debt.

Kohl’s Debt Accumulation (Calculated and Charted by Waterside Insight with data from company)

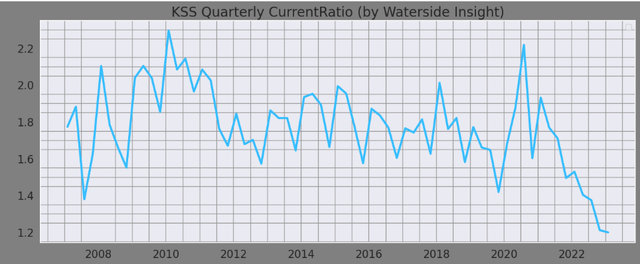

The company’s current ratio also shows constraints. It has dropped to its lowest level in more than a decade. Although it is still at 1.2 times, the company’s higher debt burden, especially for the short-term interest payment, will leave the company with less flexibility.

Kohl’s Current Ratio (Calculated and Charted by Waterside Insight with data from company)

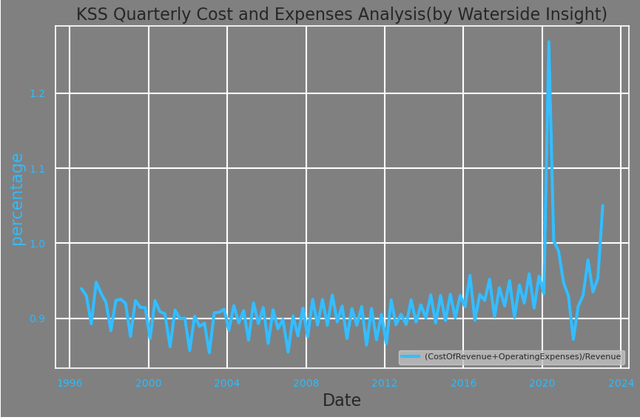

Cost and expenses together as a percentage of revenue haven’t been able to return to the pre-pandemic level yet. They are about 1.05x of the revenue. The company cited the higher selling, general and administrative expenses (SG&A) are mainly due to the store strategy, which came from a large number of Sephora store openings. Although the company stated to expect them to decrease in 2023 due to less Sephora shops opening than in ’22, it needs to cut them down by another 10-15% in order to align with its historical levels.

Kohl’s Costs and Expenses (Calculated and Charted by Waterside Insight with data from company)

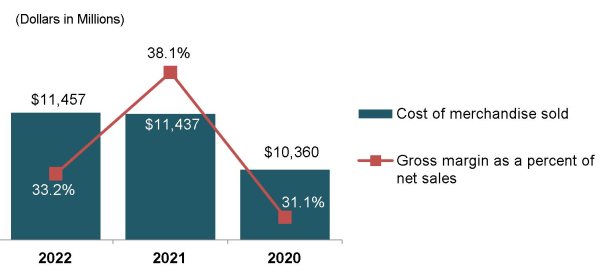

There is a stickiness in cost and expenses for the retailers that will be hard to change in the near term. For example, from 2021 to 2022, its net sales decreased from $18.5 to $17.2 billion, but the cost of merchandise remained almost the same. As a result, the gross margin has decreased from 38.1% to 33.2%. In addition, the operating profits from Sephora shops are shared equally, and the part shared to Sephora is recorded in the cost of merchandise. This provides another reason it will be hard to see the cost and expenses come down.

Kohl’s Cost of Merchandise vs Gross Margin (Company 2022 10K)

Big Picture

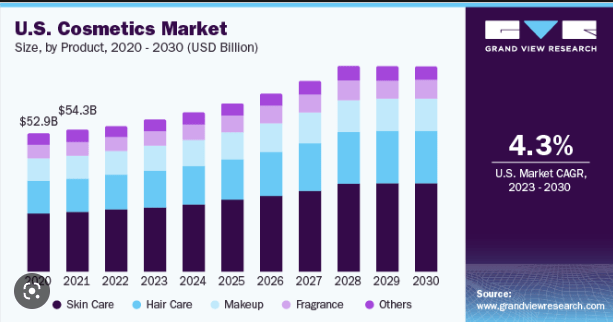

The US’ cosmetic market is seen to grow at a pace of 3.9% CAGR per year from 2021-2030, with the possibility to plateau later on. Kohl’s bet on developing more exposure to this market through the partnership with Sephora will anchor in the range of this rate for long-term growth.

US Cosmetic Market Growth (www.grandview.com)

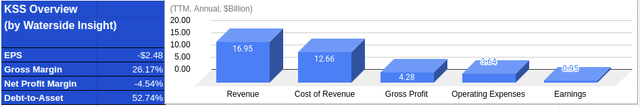

Financial Overview

Kohl’s Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Valuation

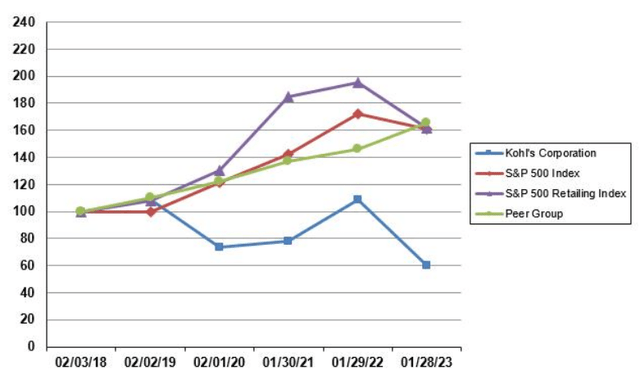

In the past five-year, Kohl’s return has been weak compared to the broader market and its peers by almost 100 bps accumulatively. This trend has dipped lower in the latest turn.

Kohl’s Five Year Return History (Company 2022 10K)

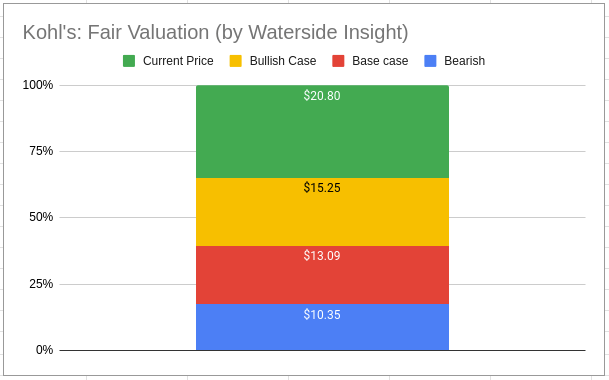

We combine all our analysis above and use our proprietary models to assess Kohl’s fair valuation with a ten-year forward projection. In our bullish case, the company has weaker growth in ’23 and ’24 but sees faster recovery in ’25, with longer-term projected growth staying modest; it is valued at $15.25. In our bearish case, the higher debt burden starts to catch up with its growth compounded with recessionary pressure in the next two years; with modest, long-term growth but more volatility embedded, it is valued at $10.35. In our base case, the pressure of slower macro growth and higher debt burden is a near-term hurdle for the company; although it is seeing growth from its Sephora shops, the mixture will be blended with modest, long-term growth, it is valued at $13.09. The current market price, although as fallen from a high of $64 in 2022, is still higher than our upper estimate.

Kohl’s Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

With a large number of stores and an extended network, Kohl’s has made some recovery from the hit of the pandemic. But the company’s overall profitability is still under pressure. Its aggressive bet on cosmetic carrier Sephora to revive better growth still needs to be proven successful. With a thinner margin and higher cost and expenses base, it is currently in, Kohl’s still has more way to go in order to become less vulnerable to external pressure in the economy. Its current market price hasn’t fully factored in the risks, in our opinion. We will recommend a sell at this level.

[ad_2]

Source link